10 Simple Techniques For Hard Money Georgia

Wiki Article

Some Known Factual Statements About Hard Money Georgia

Table of ContentsHard Money Georgia Things To Know Before You Buy6 Easy Facts About Hard Money Georgia ExplainedHard Money Georgia for DummiesA Biased View of Hard Money Georgia6 Simple Techniques For Hard Money Georgia

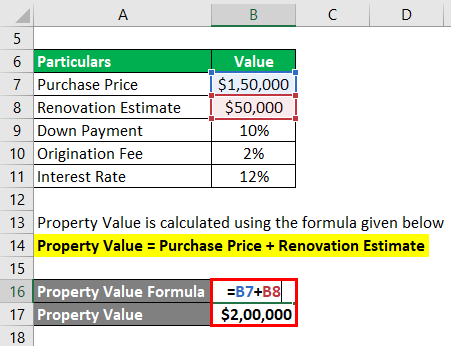

, are short-term lending tools that actual estate financiers can utilize to fund an investment task.There are two primary drawbacks to think about: Hard cash car loans are practical, but investors pay a rate for obtaining this means. The rate can be up to 10 portion factors greater than for a traditional financing.

Consequently, these car loans include much shorter repayment terms than standard home loan. When picking a difficult money lending institution, it is essential to have a clear suggestion of just how quickly the home will certainly end up being successful to ensure that you'll be able to repay the car loan in a prompt way. There are numerous good factors to take into consideration getting a tough cash financing as opposed to a standard mortgage from a bank.

More About Hard Money Georgia

Once again, lenders may permit financiers a bit of freedom right here.Tough money lendings are a good fit for affluent investors that require to get funding for an investment property swiftly, with no of the red tape that supports bank funding. When assessing hard cash lenders, pay close interest to the fees, passion rates, and also loan terms. If you wind up paying too a lot for a hard cash lending or cut the repayment duration too short, that can affect how successful your property venture is in the long term.

If you're seeking to buy a residence to turn or as a rental property, it can be testing to get a traditional home mortgage. If your credit rating isn't where a traditional loan provider would certainly like it or you require money faster than a loan provider is able to offer it, you might be unfortunate.

The Only Guide for Hard Money Georgia

Hard cash finances are short-term guaranteed fundings that utilize the residential property you're acquiring as security. You will not locate one from your financial institution: Tough money loans are supplied by alternative loan providers such as specific capitalists as well as private business, who normally neglect average credit report and also various other financial aspects as well as rather base their decision on the building to be collateralized (hard money georgia).

Hard cash financings give numerous benefits for borrowers. These consist of: From begin to end up, a difficult money finance might take just a couple of days. Why? Hard cash loan providers tend to position more weight on the value go to website of a residential property made use of as security than on a customer's financial resources. That's because difficult money loan providers aren't called for to adhere to the same laws that traditional lenders are.

It's crucial to hop over to here consider all the risks they expose. While difficult money financings come with benefits, a debtor must additionally think about the risks. Among them are: Hard money lending institutions usually bill a greater interest rate due to the fact that they're thinking even more risk than a standard loan provider would certainly. Once more, that's because of the threat that a difficult cash lending institution is taking.

The Basic Principles Of Hard Money Georgia

You're not sure whether you can pay for to settle the tough cash finance in a short amount of time. You've obtained a strong debt score and must have the ability to get approved for a traditional finance that most likely carries a lower rate of interest. Alternatives to hard money financings click here for more include typical mortgages, residence equity car loans, friends-and-family loans or financing from the property's vendor.

The Hard Money Georgia Statements

It's vital to consider elements such as the lender's reputation and rate of interest. You might ask a trusted genuine estate representative or a fellow house flipper for referrals. As soon as you have actually pin down the appropriate hard money lender, be prepared to: Develop the deposit, which typically is heftier than the down repayment for a traditional home mortgage Collect the essential documents, such as evidence of earnings Potentially hire an attorney to discuss the terms of the loan after you've been approved Draw up a strategy for settling the finance Equally as with any kind of financing, evaluate the advantages and disadvantages of a difficult cash funding before you devote to borrowing.No matter what kind of lending you pick, it's probably an excellent suggestion to check your complimentary credit report score and cost-free credit rating record with Experian to see where your funds stand.

(or "exclusive cash loan") what's the first thing that goes via your mind? In previous years, some negative apples tarnished the tough cash lending sector when a couple of aggressive lending institutions were trying to "loan-to-own", supplying really high-risk fundings to debtors making use of actual estate as collateral and intending to confiscate on the residential or commercial properties.

Report this wiki page